Citi Bank Personal Loan In this article we Citibank Personal Loan Will get information about | If you want to take a personal loan from Citibank, then this article is for you.

You can take this loan for any kind of personal expenses. in present time Citibank Personal Loan interest rates starting from 10.50% p.a. it occurs. Under this loan, you can get a loan of up to Rs.30 lakh. The tenure of this loan is up to 60 months.

Citibank Personal Loan in Hindi 2022

Citibank Personal Loan As the name itself suggests, when we take a loan for any of our personal expenses, it is called a personal loan. Any person can take Citibank Personal Loan for marriage expenses, traveling, medical expenses, paying children’s fees etc.

You have to apply for this loan. You can apply for this loan both online and offline. Personal loan depends on your credit score. The better your CIBIL score, the higher the personal loan amount you can avail.

HIGHLIGHTS:

| loan name | Citibank Personal Loan 2022 |

| Name of the lending bank | City Bank |

| loan tenure | max 60 months |

| loan amount | up to a maximum of Rs.30 lakh |

| Rate of interest | Starting from 10.50% p.a. |

| processing fee | Up to 3% of the loan amount |

| foreclosure charges | Up to 4% of the loan principal |

| application mode | online / offline |

| official website | www.online.citibank.co.in |

Citibank Personal Loan Interest Rate 2022

Citibank’s Personal Loan Interest Rates 10.50% p.a. 1000 and can go up to 16.49% per annum. If you are an existing customer of the bank, then you can also take advantage of the bank’s attractive interest rates.

Citibank Personal Loan Benefits and Features

- Any salaried person or self-employed person can apply for this personal loan.

- You can get a personal loan up to a maximum of Rs 30 lakh from Citibank.

- You can apply for this loan by visiting the nearest branch of the bank or online from the official website of the bank.

- The loan amount is transferred to your bank account within 48 hours of loan approval.

- You can get your personal loan eligibility in just 4 hours.

- Part pre-payment option available.

- You can repay your loan after a minimum of 12 months.

- You have to pay a booking fee of up to 3% of the sanctioned loan amount.

- You can avail this loan with minimal documentation and quick loan approval.

- You can avail Citibank Personal Loan for wedding expenses, to pay emergency medical bills or for any other personal purpose.

- If you fulfill all the conditions of this loan then you can get instant personal loan.

Citibank Personal Loan Eligibility

- Any salaried person or self-employed person is eligible for this loan.

- The minimum monthly income of the applicant should be Rs 25,000.

- The age of the applicant should be from 21 to 60 years.

- To take a personal loan, you have to apply in it.

Citibank Personal Loan Documents Required

The documents required to apply for a personal loan are as follows:

| Criteria | documents for salaried | documents for self employment | Documents for Overseas (Additional) |

|---|---|---|---|

| identity proof | photograph is mandatory Passport driving license Voter ID Card job card Aadhar card National Population Register (containing name and address details) |

photograph is mandatory Passport driving license Voter ID Card job card Aadhar card National Population Register (containing name and address details) |

valid passport valid visa |

| proof of residence | photograph is mandatory Passport driving license Voter ID Card job card Aadhar card National Population Register (containing name and address details) |

photograph is mandatory Passport driving license Voter ID Card job card Aadhar card National Population Register (containing name and address details) |

valid passport valid visa Documents issued by government departments of foreign jurisdictions Letter issued by Foreign Embassy/Mission in India |

| proof of age | Passport driving license Voter ID Card job card Aadhar card National Population Register (containing name and address details) |

Passport driving license Voter ID Card job card Aadhar card National Population Register (containing name and address details) |

|

| Length of Employment/Continuity of Business | letter from employer Present and previous employer salary slip/Form 16 HR Investigation by Designated CPA Resource |

Lease Deed/ Rent Receipts ownership document utility bills Tax return from same city 3 years old bank statement |

|

| Income and business proof | Latest 2 pay slips (not older than 3 months)

Last 3 months bank statement |

1 Year Personal IT Return Computation of Income Schedule 1 Year Audited P&L Last 3 months bank statement |

How to apply for Citibank Personal Loan?

Follow the steps given below to apply for this loan:

Citibank personal loan apply online

- On the home page of the website, in the option of Loans, the option of Personal Loan will appear, click on it.

- On the next page, all the information related to personal loan will appear in front of you.

- on this page you Click 4 Call The option of will appear, click on it.

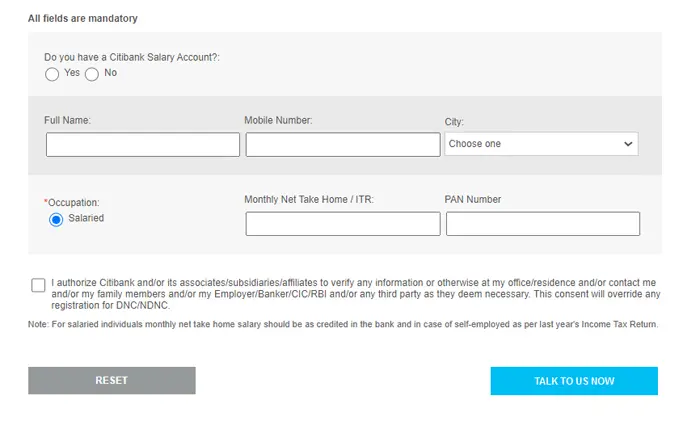

- The form will open in front of you on the next page.

- Enter all the information sought in the form correctly and submit the form.

- After that the bank will contact you and proceed with the loan process.

- If you fulfill all the conditions of the bank, then your loan will be approved and the loan amount will be transferred to your bank account within 48 hours of loan approval.

How to apply offline?

- First of all, you have to go to your nearest Citibank branch.

- You will have to contact the bank employee by going to the bank.

- The bank employee will provide you all the personal loan related information.

- After that your documents will be verified.

- If you fulfill all the conditions of the bank, then your loan will be approved and the loan amount will be transferred to your bank account.

Personal Loan Fees And Charges

The Citibank personal loan fees and charges are as follows:

| booking fee | Up to 3% of the sanctioned loan amount |

| late payment fee | no late payment fee |

| Loan Pre-closure Charges | Up to 4% on the total principal outstanding |

| stamp duty | applicable and prevailing state laws on the loan agreement Charged accordingly. |

Citibank Personal Loan Customer Care Number

- Toll Free Number – 1860 210 2484

conclusion

In this article we have given you How to get loan from Citibank Complete information about has been provided. Anyone who wants to get a personal loan from Citibank can apply for Citibank personal loan by reading this article.

If you are facing any problem in applying for this loan or you want to get other information related to this loan, then you can get information by calling Citibank Personal Loan Customer Care Number.

FAQ:

The interest rate of this loan starts from 10.50% per annum.

Ans. Up to a maximum of Rs.30 lakhs.

Maximum 60 Months |