SBI Car Loan: In this article, you will get information about SBI Bank Car Loan. If your dream is to buy a car and you are short of money, then you can join SBI Bank’s car loan. Before applying for a car loan, you should know completely what is a car loan?

You can take a car loan to buy any type of new car, old or luxury car. You can apply for this loan both online and offline.

SBI Car Loan in Hindi

Your CIBIL Score is very important to avail SBI Car Loan. If your credit history is very good, then you can take advantage of the bank’s attractive Car Loan Interest Rate. The bank offers a wide range of SBI Car Loans. Loan amount and eligibility etc. can be different in different car loans.

Under this loan, you can get financial assistance up to 90% of the on-road price of the car. The loan tenure is up to a maximum of 7 years. You can avail the loan with the lowest interest rate and minimum EMI. in present time SBI Car Loan Interest 7.25% p.a. in 2022 starts from.

HIGHLIGHTS

| loan name | sbi car loan 2022 |

| lender | State Bank of India |

| loan tenure | maximum 7 years |

| Rate of interest | Starting at 7.25% p.a. |

| processing fee | Up to 1.25% of the loan amount + GST Minimum: Rs 3750 Maximum: Rs.10000 |

| loan amount | Up to 90% of on road price |

| application mode | online / offline |

| official website | sbi.co.in |

SBI Car Loan Interest Rate 2022

At present, SBI car loan interest starts from 7.25% per annum. This interest rate may vary depending on your credit history and the type of car loan. Before applying for a car loan from any lender, you must have a proper knowledge about the interest rate of that loan.

If you have proper knowledge about the interest rate, then you can easily determine the EMI of your loan. Higher the interest rate of your loan, higher will be the EMI.

SBI Car Loan Benefits and Features

- You can take advantage of this loan to buy any type of car of your dreams, new car, old car or luxury car.

- SBI car loan The term is up to a maximum of 7 years.

- You can avail loan up to 90% of the on road price of the car.

- No upfront EMI.

- Interest is calculated on daily reducing balance basis.

- The bank provides optional SBI Life Insurance cover on the car loan.

- For more details, you can contact SBI Car Loan customer care number or visit your nearest bank branch.

- The processing fee is different for different loan amounts.

- Before applying for the car loan, you should calculate your loan EMI with the help of SBI car loan calculator to get an idea of the amount of EMI you will have to pay at the time of loan repayment.

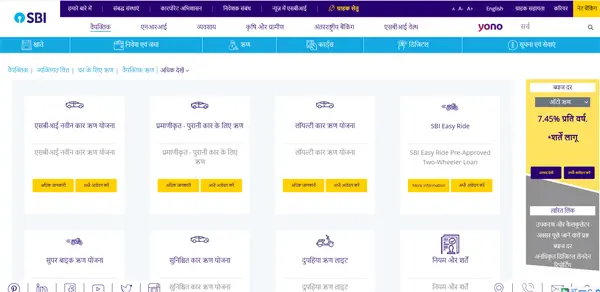

Types of SBI Car Loan

The bank offers various types of State Bank of India Car Loan as per the needs of the customers. The features of all these loans are different which you can know here:

- SBI New Car Loan Scheme

- Verified – Loans Against Used Car

- SBI Loyalty Car Loan Scheme

- SBI Assured Car Loan Scheme

- As the name suggests, you can avail this loan to buy a new car.

- The repayment period of this loan is up to a maximum of 7 years.

- The applicant is also given an optional SBI Life Insurance cover under this loan.

- To buy new passenger cars, Multi Utility Vehicles (MUVs) and SUVs, you can use this SBI New Car Loan can take advantage of.

- You can avail loan up to 90% of the cost of the vehicle.

Verified – Loans for Used Car:

- As the name suggests, you can avail this loan to buy a used car.

- Under this loan, you can get a minimum loan amount of Rs.3 lakh and a maximum loan amount of Rs.100 lakh.

- The repayment period of this loan is 10 years (maximum 5 years) less the life of the vehicle.

- LTV: 85% of ex-showroom price.

- margin 20%

- Penal Interest: 2% p.m. on the overdue amount.

SBI Loyalty Car Loan Scheme:

- The repayment period of this loan is up to a maximum of 7 years.

- No pre-payment fee is charged.

- EMI/NMI is as per the car loan scheme.

- To take advantage of this SBI Car Loan, the annual income of the applicant should be at least Rs 2 lakh.

SBI Assured Car Loan Scheme:

- Under this loan scheme, you can get a minimum loan amount of Rs.2 lakh, there is no maximum limit.

- The repayment period of the loan is from 3 to 7 years.

- Anyone who is 18 years or above can take advantage of this loan.

- There is no upper age limit.

- EMI/ NMI Ratio – Not applicable.

- Minimum Income Criteria: : Income declared by the applicant will be accepted.

SBI Green Car Loan Scheme:

- You can take this loan for a maximum loan period of 3 years to 8 years.

- Additional discount of 20 bps on interest rates applicable on normal car loans for all categories of customers.

- You can avail loan up to 90% of the on-road price of the vehicle.

- Any person in the age group of 21 years to 67 years can take advantage of this loan.

SBI Car Loan Eligibility

- The age of the applicant should be between 21 to 67 years.

You can know more about eligibility in the table below:

| square | income criteria | maximum loan amount |

|---|---|---|

| Regular employees of Central Public Sector Undertakings (Maharatna/Navratna/Miniratna). Defense Pay Package (DSP), Para Military Pay Package (PMSB) and Indian Coast Guard Pay Package (IGSP) subscribers and Short Commissioned Officers of various Defense Establishments. | The annual income should be at least Rs.3 lakh. | 48 times of net income |

| Professionals, Self Employed, Traders, Proprietorship/Partnership Firms and others who are income tax payers. | Annual income minimum Rs 3 lakh | 4 times net income |

| Persons engaged in agriculture and other allied activities. Income tax return is not required in case of farmers. | The minimum annual income of the applicant should be Rs.4 lakh. | 3 times the net income |

SBI Car Loan Document Required

- Filled Application Form.

- Proof of Identity (copy of any one): Passport/PAN Card/Voter ID Card/Driving License etc.

- Address Proof (copy of any one): Ration Card/ Driving License/ Voter ID Card, Passport, Telephone Bill/ Electricity Bill, Life Insurance Policy.

You must have the following documents along with the filled application form:

For Salaried:

- Bank account statement of last 6 months

- 2 passport size photographs

- proof of identification

- proof of address

- Income Proof: Latest Salary Slip, Form 16

- Income tax return or Form 16 for the last two years

For Non-Salaried / Professional / Traders:

- Bank Account Statement for the last 6 months

- 2 passport size photographs

- identity proof

- address proof

- Income proof: ITR of last two years

- Income tax returns of the last two years or Form 16.

- Two years Audited Balance Sheet, Profit & Loss Statement, Shops and Establishment Act Certificate / Sales Tax Certificate / SSI Registered Certificate, Copy of Partnership.

For person engaged in agriculture and allied activities:

- Bank Account Statement for the last 6 months

- 2 passport size photographs

- identity proof

- address proof

- direct agricultural activity (growing crops)

- Khatra/ Chitta Adangal (which shows the crop pattern) Patta/ Khatauni (by which land holding is established) with photo.

- All the land should be fully owned and the proof of ownership should be in the name of the customer.

- Allied Agricultural Activity (eg Dairy, Poultry, Horticulture): Proof related to your activities will have to be submitted.

How to apply for SBI New Car Loan?

You can apply for this loan both online and offline. Follow the steps given below to apply.

State Bank of India Car Loan Apply Online

- To apply online, first you have to visit the official website of SBI Bank.

- then you car loan Have to click on the option.

- After clicking, a list of all car loans will appear in front of you.

- on the loan you want to apply for Apply Now Click on the option.

- An application form will open in front of you.

- Enter some necessary details in it and click on submit.

- After this the representative of the bank will contact you and the loan process will be continued further.

- If your loan is approved, the loan amount is transferred to your bank account.

How to apply offline?

- If you do not want to apply online for car loan, then you can also apply offline.

- For this, first of all you have to go to your nearest State Bank of India branch with all your necessary documents.

- The representative of the bank will verify all your documents.

- Then you have to fill the application form and complete the necessary process for the loan.

- Fill the form and submit it to the bank.

- In this way your offline application will be done.

SBI Car Loan Customer Care Number

- Customer Care Number : 1800-11-2211 / 7208933142 / 7208933145

Conclusion

In this article we have given you SBI Car Loan in Hindi Complete information about has been provided. You can avail this loan to buy any type of car. If you want to get any other information about the loan, then you can get the information by calling the customer care number of the bank.

I hope you guys find this article informative. If you have liked this article, then please share it as much as possible.

SBI Car Loan FAQs:

Up to 90% of the cost of the car.

Starting at 7.25% p.a.

You can find this out by comparing various car loans.